Nearly four weeks ago, we put down a marker for what lay ahead for the S&P 500 based on the index' quarterly dividend futures.

Looking beyond 2024-Q2, you'll see something unusual. There's projected drop-off in quarterly dividends between 2024-Q2 and 2024-Q3. It's unusual because we would ordinarily expect to see the third quarter's anticipated dividends fall in between the projected values for the second and fourth quarters. And since the outlook for the index' dividends in all quarters has been improving, we would have at least expected to see it close the gap between the second and fourth quarter's values.

But it hasn't. If anything, the projected drop-off in the dividends expected to be paid from 2024-Q2 to 2024-Q3 has been remarkably persistent in all the months we have been observing it and has increased in size. That persistence suggests investors have potentially built in expectations of turbulence ahead for dividend paying stocks.

That market turbulence would most likely take place during the upcoming quarter of 2024-Q2, which would subsequently show up in the dividends paid in the following quarter of 2024-Q3.

We're not even three full weeks into 2024-Q2 and the leading edge of that forecast market turbulence would appear to have arrived. The S&P 500 has dropped nearly four percent from the record high level it reached at the end of March 2024. Here's what the S&P 500's quarterly dividend futures look like as of Monday, 15 April 2024:

As expected, we've also had to reset the vertical scale of this chart to accommodate the dividends expected to be paid out in 2024-Q2, which has risen from $18.96 to $19.11 per share since our last snapshot.

Meanwhile, the amount of dividends expected to be paid out by S&P 500 firms during 2024-Q3 has decreased, falling from $17.82 to $17.72 during the last four weeks. The projected dividends for 2024-Q4 has likewise fallen, dropping from $18.45 to $18.31 during this interval.

The decline in expectations for the S&P 500's quarterly dividends in these future quarters is a consequence of a change in expectations for how the Federal Reserve will set short term interest rates in the U.S. Four weeks ago, the CME Group's FedWatch Tool indicated investors expected the Fed would launch a series of quarter point rate cuts at six-to-twelve week intervals before the end of 2024-Q2. As of 15 April 2024, the FedWatch Tool projects the Fed will only cut the Federal Funds Rate once during 2024. That cut is anticipated in September.

With U.S. interest rates being held higher for longer, the resulting higher cost of paying interest for borrowing money is expected to reduce the earnings of many of the companies whose stocks make up the S&P 500 index. Those lower earnings, in turn, mean lower dividend payouts.

There is a bright spot in this outlook, for which we also put down a marker with its own cautionary note:

Since quarterly dividends are projected to rise in 2024-Q4, that suggests investors expect this turbulence will be relatively short-lived.

At least, that's the implied expectation at this juncture. The most important thing to remember about the future is that it's subject to change with little notice.

A lot has changed in the last four weeks. Our next planned snapshot of S&P 500 quarterly dividend futures and what they indicate will be in five weeks.

Image Credit: Microsoft Copilot Designer. Prompt: "A fortune teller looking into a crystal ball to make a prediction about the S&P 500".

Labels: dividends, forecasting, SP 500

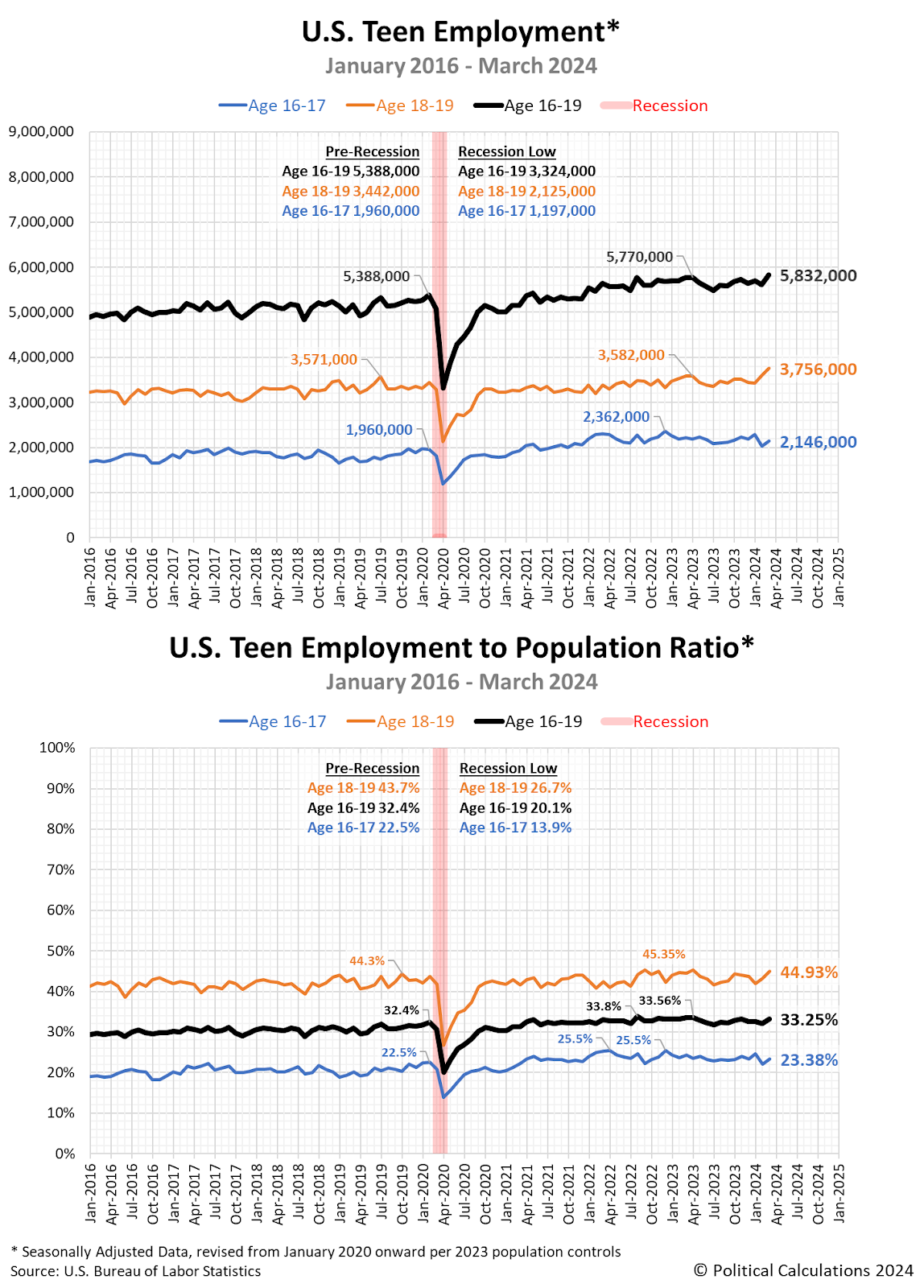

According to the U.S. Bureau of Labor Statistics, teen employment surged in March 2024.

The seasonally-adjusted figures are pretty impressive. The number of teens Age 16 to 19 counted as employed jumped by 224,000 to reach 5,832,000 from February to March 2024. That's the highest reported figure since April 2008.

The employment situation in March 2024 was especially good for older teens. The number of Americans Age 18 and 19 with jobs rose 161,000 from the previous month's seasonally-adjusted total to 3,756,000, the highest this figure has been since May 2008.

Younger teens, Age 16 and 17, also saw a pickup in their number of employed, which rose 111,000 to a seasonally-adjusted 2,146,000 in March 2024. That figure is 6.5% below below their March 2022 peak, where we have to go back to mid-2007 to find a higher number of employed younger teens. With respect to that March 2022 peak, while March 2024 was positive, an overall downtrend for younger teens remains in place.

The following chart set visualizes the seasonally-adjusted numbers for the number of working teens in the U.S., showing the employment figures and employment-to-population percentages for younger teens (Age 16-17) and older teens (Age 18-19) as well as the combined population of working Age 16-19 year olds.

The share of employed teens among the population of Americans Age 16-19 remains below their 2023 peaks, but all in all, March 2024 was a good month for teens with working ambitions.

References

U.S. Bureau of Labor Statistics. Labor Force Statistics (Current Population Survey - CPS). [Online Database]. Accessed: 5 April 2024.

Image Credit: Microsoft Copilot Designer. Prompt: "Editorial cartoon of teenagers lining up to interview for a job at a store."

Labels: jobs

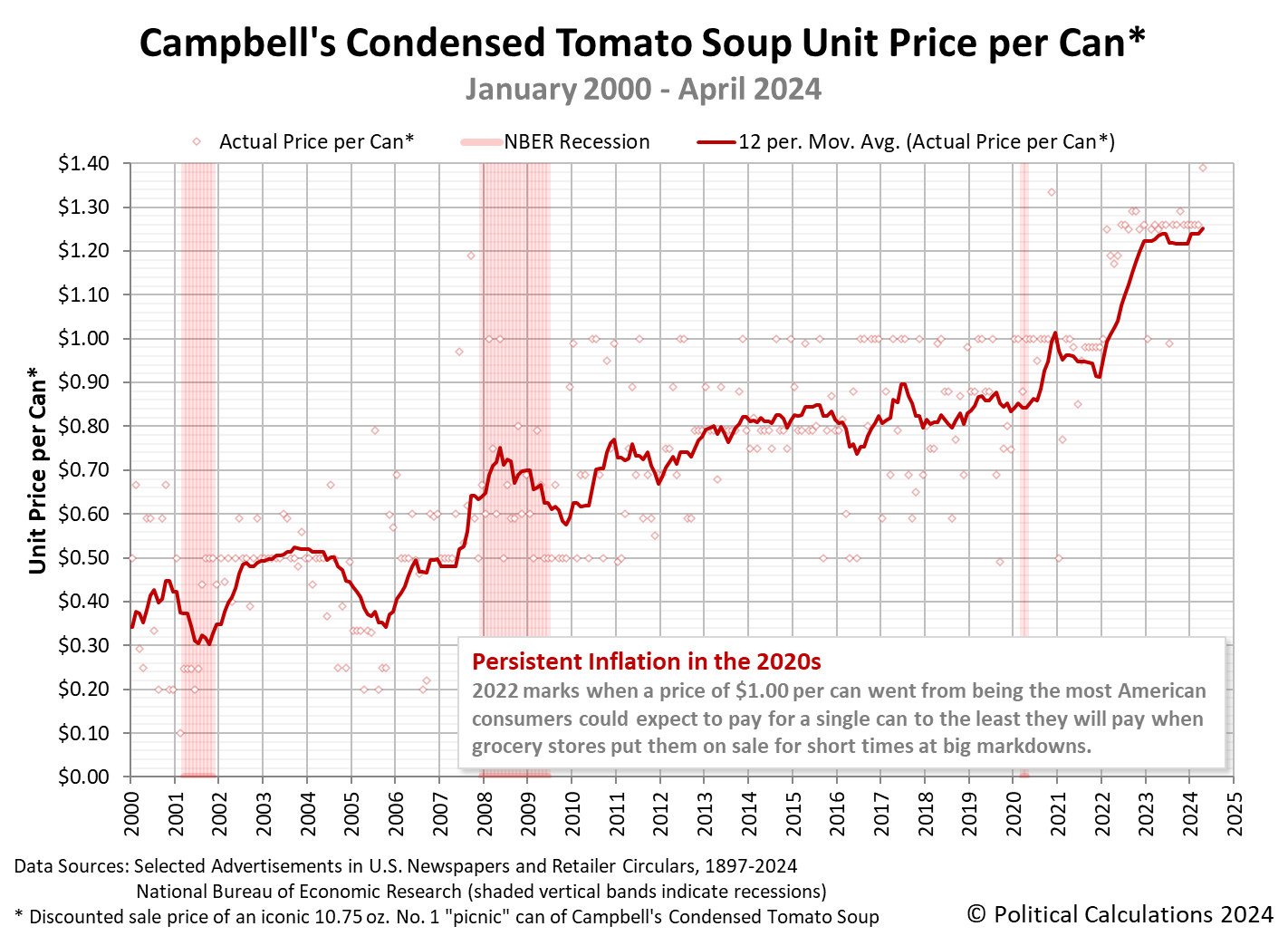

Inflationary price increases have resumed for Campbell's Tomato Soup.

Our monthly survey of the prices at which ten major grocery retailers are selling an iconic Number 1 size can of Campbell's Condensed Tomato Soup indicates upward price movement has resumed after stabilizing during the latter half of 2023.

The changes we're observing are significant for U.S. consumers because Campbell Soup (NYSE: CPB) has produced and sold its condensed tomato soup product in this standard 10.75 fluid ounce can continuously since January 1898. Because of that inherent characteristic, its price is not affected by the marketing trick of shrinkflation, in which producers try to hold their shelf prices steady for consumers in the face of sustained inflation by reducing the quantity of goods contained within their packaging. Its price cannot hide the corrosive effects of inflation within the economy.

Here are the prices we're observing in our mid-April 2024 survey along with how they have changed since our January 2024 report:

- Walmart: $1.26/each, unchanged

- Amazon: $1.26/each, decrease of $0.73 (-36.7%)

- Kroger: $1.39/each, increase of $0.10 (+7.8%)

- Walgreens: $1.99/each, unchanged

- Target: $1.39/each, unchanged

- CVS: $2.49/each, increase of $0.60 (+31.7%)

- Albertsons: $1.69/each, increase of $0.20 (+13.4%)

- Food Lion: $1.25/each, unchanged

- H-E-B: $1.31/each, unchanged

- Meijer: $1.29/each, unchanged

We think the most significant price change is the shelf price increase at Kroger-affiliated grocers. The Kroger (NYSE: KRO) family of grocery stores is the largest chain for this category of retailers in the United States. By comparison, Walmart (NYSE: WMT) is a larger retailer, but sells far more categories of consumer goods than just groceries. Together, these two companies sell more cans of tomato soup than many of the other grocers combined.

That includes Amazon, which is the only grocery-selling retailer to decrease their price in this report and which sells far fewer cans of soup than either Walmart or Kroger. Amazon is unusual among our surveyed grocery sellers in having very volatile pricing for Campbell's Condensed Tomato Soup, showing large swings in price from month to month. Our main takeaway in the online retailer's price for a single picnic-size can of Campbell's second-biggest selling soup product is that its April 2024 unit price is not less than $1.26, which is close to the floor among all our surveyed stores.

The following chart tracks the changing price of a 10.75 ounce can of Campbell's Condensed Tomato Soup from January 2000 through April 2024. (See this article for a chart visualizing our full price history from January 1898 through January 2024).

The trailing twelve month average price of a single can of Campbell's Condensed Tomato Soup is $1.25 in April 2024. This figure is 30% higher than what it was in March 2021 and is consistent with how overall food prices have changed in the U.S. economy in the period since the current era of elevated inflation began.

Image Credit: Microsoft Copilot Designer. Prompt: "A can of Campbell's Condensed Tomato Soup".

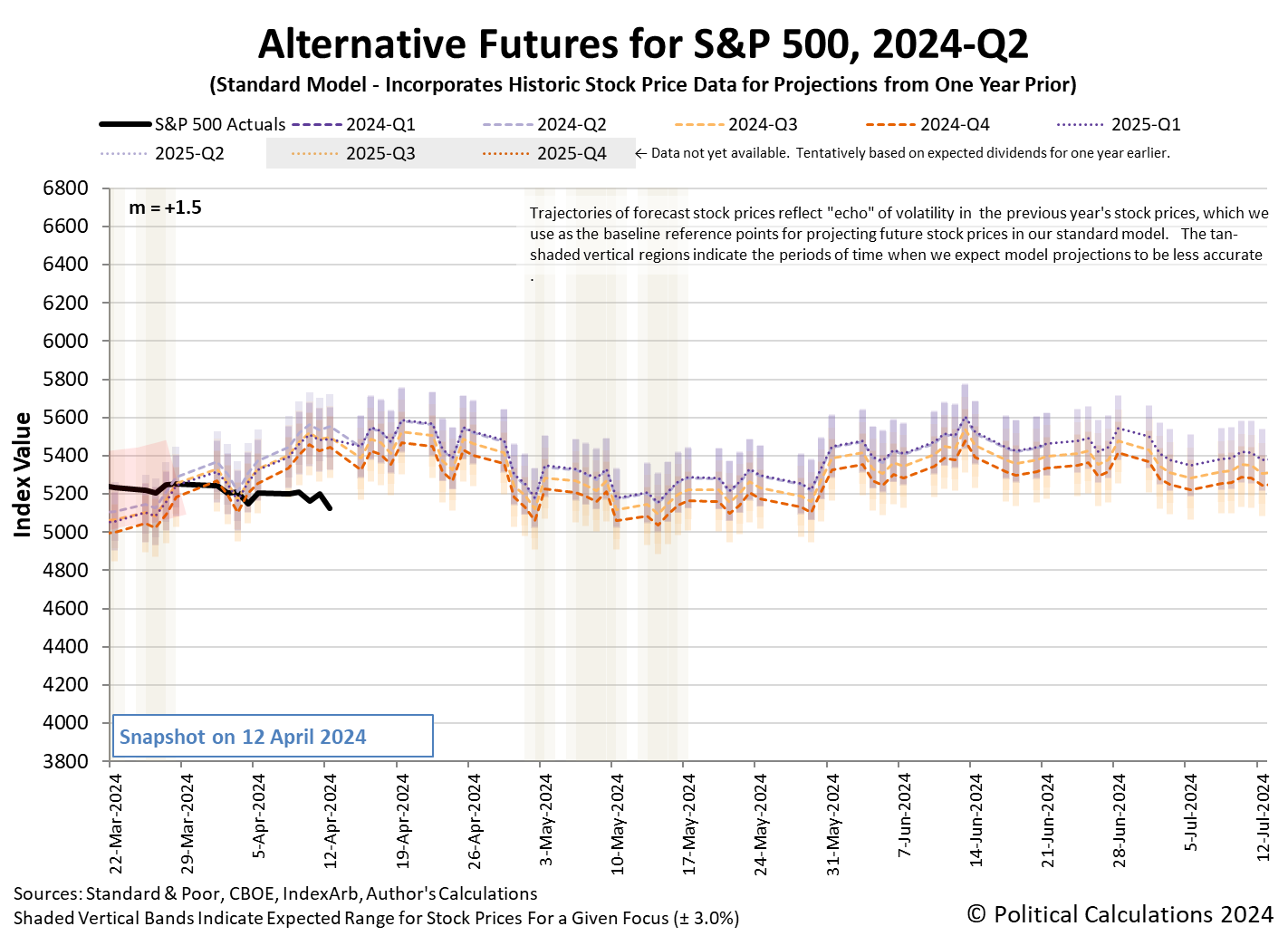

The repercussions of delayed rate cuts continued to shake out in the U.S. stock market in the past week. Overall, the S&P 500 (Index: SPX) dropped a little over 1.5% from where it ended the previous week to close at 5,123.41 on Friday, 12 April 2024.

Most of that decline came on Friday. Bad news came in the form of diminished earning expectations for big U.S. banks, whose previous outlook had counted on the Federal Reserve delivering rate cuts starting before the end of 2024-Q2.

Speaking of which, with the change in outlook for rate cuts, the CME Group's FedWatch Tool now projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 31 July 2024. The tool also projects just two rate cuts in 2024, one on 31 July (2024-Q3), the other in December (2024-Q4). And a first rate cut on 31 July 2024 is looking shaky.

We've rolled the alternative futures chart forward to show the dividend futures-based model's projections for the S&P 500 through the second quarter of 2024.

We find the actual trajectory of the S&P 500 running below the model's projections, with the deviation taking place entirely during the past week. Right now, it's too early to tell if that's a consequence of a regime change in the market, which is on the table because of the change in expectations for the Fed's rate cuts. A regime change would mean the dividend futures-based model's multiplier has itself changed from the value of +1.5 it has mostly held since 9 March 2023. We'll be able to make that determination within the next few weeks.

In the meantime, here are the market-moving headlines from the week that was.

- Monday, 8 April 2024

-

- Signs and portents for the U.S. economy:

- Major food companies offering deals, new sizes as low-income Americans spend less

- Despite $90 crude, US oil output capped by weak natgas prices

- Oil prices dip on Middle East ceasefire talks

- Fed minions worry about "upside inflation":

- 'Upside' inflation risks keep Fed officials wary of turn to rate cuts

- Minneapolis Fed's Kashkari: Central bank can't 'stop short' on inflation fight

- Fed rate cut expectations for 2024 fall to lowest since October

- More stimulus developing in China:

- BOJ minions shocked their attempt to create inflation is working:

- Interest rate cuts developing in the Eurozone:

- Nasdaq, S&P, and Dow, ended unchanged while yields moved up

- Tuesday, 9 April 2024

-

- Signs and portents for the U.S. economy:

- US small-business sentiment slides to lowest level in more than 11 years

- US Postal Service seeks to hike stamp prices to 73 cents

- US Treasury yield forecasts rise as rate cut calls recede

- US Gulf Coast heavy crude oil prices firm as supplies tighten

- Bigger stimulus gaining traction in China:

- BOJ minions say they'll keep money spigots open:

- Bigger trouble developing in Eurozone:

- Nasdaq, S&P end higher in late-session recovery, Dow closes little changed ahead of CPI

- Wednesday, 10 April 2024

-

- Signs and portents for the U.S. economy:

- US consumer prices heat up in March; seen delaying Fed rate cut

- Oil settles higher after Israeli strike overshadows ceasefire talks

- As US bank profits drop, focus shifts to interest income outlook

- Fed seen cutting US interest rates later, and less, as inflation stays hot

- Fed's 'confidence' in disinflation not bolstered by recent data, minutes show

- Fed officials preparing to slow pace of balance sheet runoff

- Fed's rate-cut confidence wobbles as elevated inflation persists

- Fed looks to slice balance sheet runoff pace by half

- Bigger trouble developing in China:

- Fitch downgrades outlook on China to negative, affirms 'A+' rating

- S&P slashes property giant China Vanke's credit rating to junk

- China has been closing idled auto output capacity, industry body says

- BOJ minions want to avoid hiking interest rates for falling yen bailout:

- Wall St ends sharply lower as sticky inflation dims rate cut hopes

- Thursday, 11 April 2024

-

- Signs and portents for the U.S. economy:

- Focus: Soaring insurance costs hit as US buyers finally get a break on car prices

- July start to Fed rate cuts back in view after data

- Fed minions say they are in no hurry to deliver rate cuts, expect trouble for U.S. banks:

- Fed officials in no rush to cut rates as inflation worries rise

- Fed's Williams: Banks should be prepared to use discount window if needed

- Bigger trouble, stimulus developing in China:

- China's Q1 GDP growth set to slow to 4.6%, keeps pressure for more stimulus- Reuters poll

- China's exports likely swung back to contraction in March

- China's weak CPI, factory-gate deflation point to more stimulus

- BOJ and JapanGov minions teaming up to ready bailout for falling yen:

- Japan says it won't rule out any FX action as yen hits 34-year low

- Explainer: Why is the Japanese yen so weak?

- ECB minions getting excited to cut rates in June 2024, claim to be independent from U.S. Federal Reserve, but are they really?

- ECB holds rates at record highs, signals upcoming cut

- ECB puts June rate cut into view, asserts independence from Fed

- Nasdaq, S&P climb, Dow ends flat as investors gear up for earnings season with big banks

- Friday, 12 April 2024

-

- Signs and portents for the U.S. economy:

- Oil settles up on Middle East tensions, posts weekly loss

- US banks' profit picture less clear with cloudy rates trajectory

- Fed minions dial back rate cut expectations, worry about bailing out banks:

- Fed's Daly: absolutely no urgency to cut US interest rates

- Inflation still too high for Fed to cut interest rates, Schmid says

- Exclusive: Fed's Collins eyes about two rate cuts this year

- Less than half of U.S. banks ready to borrow from Fed in emergency

- Bigger trouble developing in China:

- Nasdaq, S&P, Dow end deep in the red as stocks suffer worst session since late January

Any effect on stock prices from Iran's attack on Israel from territory it controls in Iraq over the weekend will be seen in the week ahead.

The Atlanta Fed's GDPNow tool's latest estimate of real GDP growth for the first quarter of 2024 (2024-Q1) ticked down to +2.4% from the +2.5% growth forecast last week.

Image credit: Microsoft Copilot Designer. Prompt: "An editorial cartoon of a Federal Reserve official trying to pull down a sign while a disappointed bull watches"

Solving Sudoku puzzles has become a very popular pastime around the world since the Times of London began publishing them twenty years ago. Although the puzzle itself has been around for much longer, it was its appearance in the Times that prompted its popularity to explode.

The puzzle itself can be described as a kind of simplified crossword puzzle, but with numbers. And maybe not so simple. Sudoku.com sets out the basic rules:

Sudoku is played on a grid of 9 x 9 spaces. Within the rows and columns are 9 “squares” (made up of 3 x 3 spaces). Each row, column and square (9 spaces each) needs to be filled out with the numbers 1-9, without repeating any numbers within the row, column or square.

Sounds simple, right? In practice, how simple a Sudoku puzzle is to solve depends on how many numbers have already been filled in on it. Here's an example of a moderate-to-easy-to solve Sudoku puzzle you can try on your own.

In solving this puzzle, you're taking advantage of Sudoku's rules to fill in the missing numbers. Since each number from 1 to 9 can only appear once in each row and column, and only once in each 3 x 3 box, you can use a process of elimination to identify where the correct digits to solve the puzzle can be placed. For instance, you can probably find the right place to insert a number 9 pretty quickly just by looking at the left-most column, the bottom two rows, and the upper-left 3 x 3 box.

Like crossword puzzles, Sukoku puzzles also have a kind of symmetry to them. It's that symmetry, combined with Sukoku's rules, that offers a way to find the right places to put the missing numbers. You just have to see the secret pattern and that's what the following Numberphile video featring Cracking the Cryptic's Simon Anthony is all about:

Now that you know about the Phistomephel Ring, as this secret pattern hidden in plain sight is called, try using that knowledge to help solve your next Sudoku puzzle.

Image credit: Sudoku Puzzle by L2G-20050714 standardized layout on Wikimedia Commons. Creative Commons CC0 1.0 Universal Public Domain Dedication.

Labels: math

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.