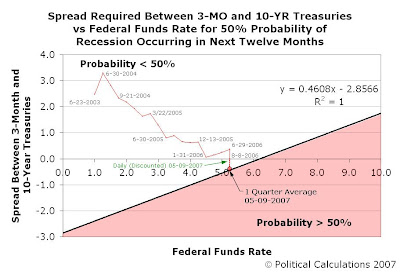

2007 is shaping up to be a recession proof year, much as our interpretation of Paul Krugman's prediction of recession back in December of 2006 suggested it would be! Here's our latest update of our recession probability tracking chart:

With today's action, or rather, non-action by the Federal Reserves' Open Market Committee, the Federal Funds Rate target remained at 5.25%. Using our recession probability tool, taking a 1-quarter rolling average of the daily closing values for the 3-month Treasury, the 10-year Treasury and the Federal Funds Rate, we find the current probability of recession occurring in the next year to be 49.3%. This probability represents a decline from the peak value of 50.1% that we saw from March 30 through April 2, 2007.

With the daily discounted yield rates for the 3-month and 10-year U.S. Treasuries having closed at 4.72% and 4.64% respectively, combined with the unchanged Federal Funds Rate of 5.25%, all these rates together produce a probability of recession occurring in the next 12 months of 39.3%. As the daily discounted Treasury yields lead the 1-quarter averaged values, this suggests that a recession is growing more and more unlikely for 2007.

Labels: recession forecast

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.